One of the most important aspects of estate planning and preparing for retirement is ensuring you have the right insurance in place to meet your potential expenses. A form of insurance that often goes overlooked is long-term care insurance. Unfortunately, many people have the misconception that Medicare will cover long-term care, but this is not the case. A recent study found that more than half of middle-income Baby Boomers are under the impression that Medicare will cover this type of care, which can involve an incredible amount of money. A person turning 65 now has a nearly 70 percent chance of needing long-term care services, and 20 percent of them will need it for more than five years. Because of this, it is critically important to think about long-term care planning, including insurance, to determine if it is necessary, as well as the best time to purchase it.

For the most part, long-term care insurance covers adult day care, nursing home stays, home care, and hospice service. Importantly, these policies may not cover the entire cost of these services, particularly for patients who end up needing years of care. However, the policies can significantly reduce costs and generally end up proving well worth the expense. These policies come into effect after certain benefit triggers, which can vary between policies, so it is important to clarify when a particular plan takes effect. Furthermore, policies frequently have a waiting period before the policy starts to pay and this delay can typically be anywhere from 20 to 100 days. Once benefits kick in, some policies provide lifetime coverage (this is increasingly rare) whereas others (most) have a maximum benefit limit or a time limit.

Since long-term care policies can vary so much in what they cover and for how long, they can come with dramatically different premiums. Moreover, several other factors affect the final premium. You should keep these factors in mind as you plan for the future and make a strategic decision about when to take out a policy. These factors include:

1. Gender

The truth is that women tend to pay more for long-term care insurance than men. This fact derives primarily from life expectancy and the tendency of women to live longer than men. Because of this, women may end up needing more coverage, or for a longer period. Statistically speaking, women do end up needing more long-term care on average than men. Also, women usually have more chronic health issues than men and thus tend to trigger the benefit more often. So it is entirely understandable that most insurers charge women more for these policies.

2. Age

One of the factors that has the biggest impact on policy price is the age at which you purchase it. Older individuals end up paying significantly more since they are much more likely to need coverage in the nearer future. The flip side is that younger people will pay into the policy for more years before they likely end up needing to use it. Thus, figuring out the ideal age can be a bit of a balancing act. You do not want to get stuck with massive premiums but you also don’t necessarily want to pay for decades when you are unlikely to need the insurance.

3. Wellness

Another critical part of the pricing process has to do with overall wellness. People with emerging health conditions typically end up paying more since they are more likely to need the coverage. In some cases, coverage may even be denied due to pre-existing conditions. This can unfortunately leave some people with very few options. So far, there are no federal regulations preventing this practice, but if that type of legislation comes down the line, it will put all or almost all of the private carriers out of business, and leave everyone with Medicaid, or some other new inferior government sponsored and administered coverage. This is much to be feared, as indigent or Medicaid eligible people in these circumstances today are already surprisingly not treated anywhere near as well as a person with one of these private insurance policies.

4. Cost of care

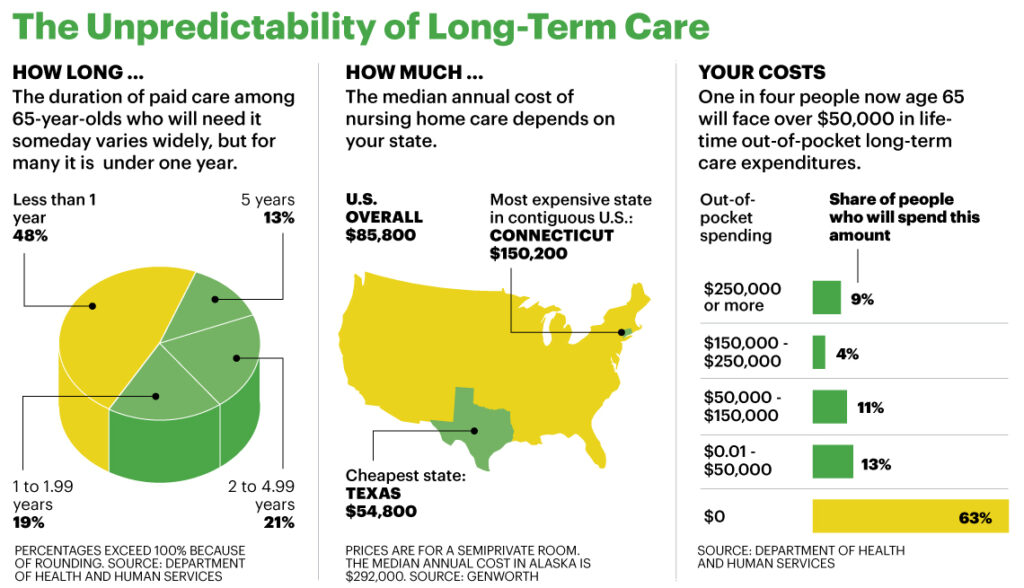

Insurance companies take into account the overall cost of long-term care when they calculate premiums. This is important to think about because not all most policies do not come with a fixed premium, and the policy cost is likely to increase over time as the cost of care rises. While these premium increases, which can be quite significant, can be annoying or troubling for retirees on a fixed budget, the increases are necessary and almost always approved by state insurance departments, so that the companies can remain healthy and profitable enough to stay in business and pay future claims. So this is especially important to keep in mind if you are planning to buy a policy early to minimize the premium. However, even with periodic premium increases, this is often a very good strategy to pursue. You should note that cost of this type care can be tricky to predict because it usually increases at a rate faster than basic inflation.

5. Type of policy

If you are married, you can apply for a joint long-term care policy and this will be significantly cheaper than two individual policies for the most part. However, it is worthwhile to check individual quotes. Remember that the different genders get priced differently so you cannot always just double the quote that one person receives. The price will also depend on how a policy’s limit is set, if it indeed has a limit. You can additionally add riders, such as inflation protection, which increases your benefit each year in accordance with inflation but which will of course cost more money.